In this article

A Flexible Spending Account (FSA) is like your personal healthcare piggy bank, letting you set aside pre-tax dollars for medical expenses. Sounds awesome, right? But before you start loading up your cart with dental goodies, know this: not everything makes the FSA-approved list. Standard toothbrushes? Sorry, they’re a no-go. The IRS considers them general health items, not essential medical expenses. So are toothbrushes FSA eligible? Get more information with me.

Does FSA cover electric toothbrushes?

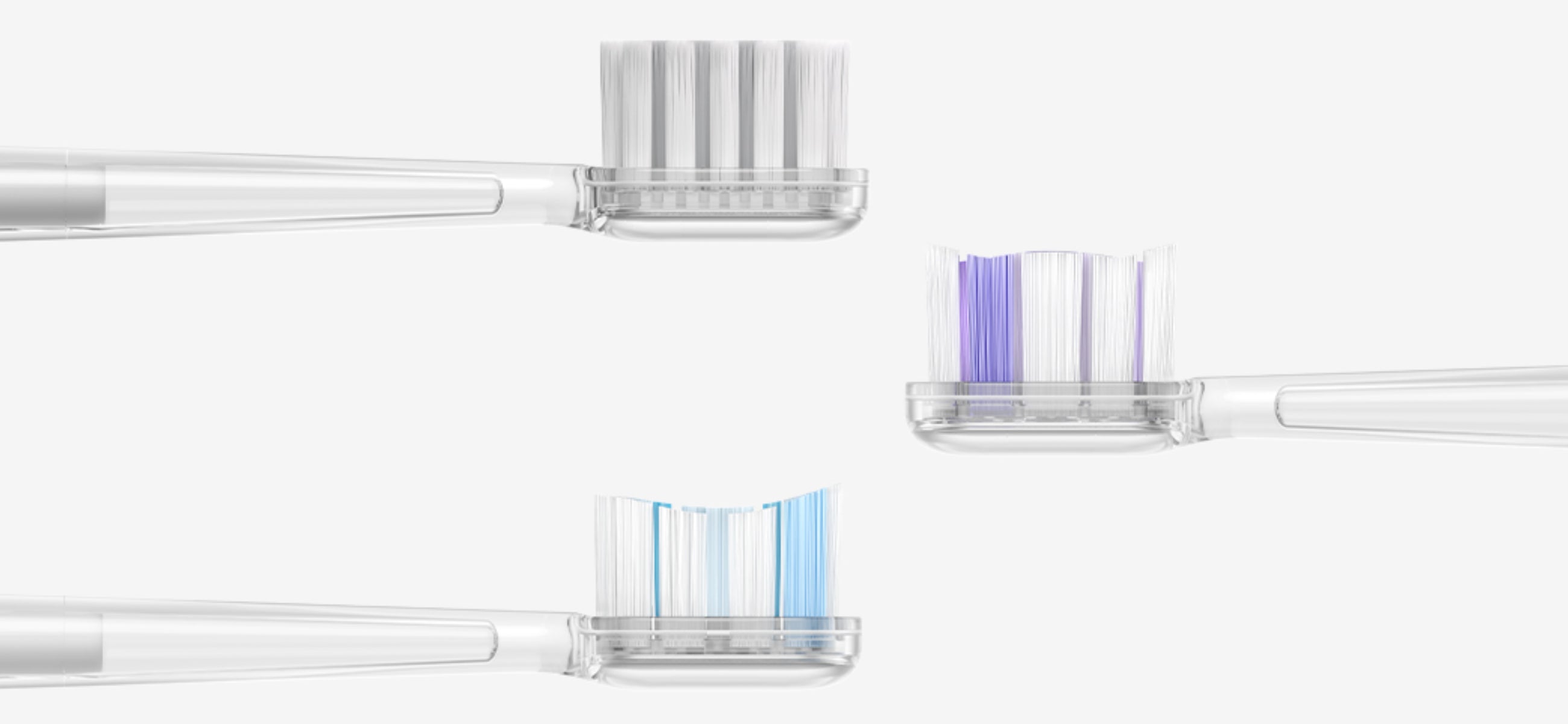

Most electric toothbrushes don’t make the cut because they’re seen as personal care items rather than medical necessities. But if your dentist recommends one for a specific condition like gum disease or serious plaque buildup, it could qualify.

To get that toothbrush covered, you’ll likely need a letter of medical necessity from your dentist. Hold onto your receipt, too, because you’ll want to submit both to your FSA provider. While the toothbrush itself might be a gray area, accessories like specialized brush heads or orthodontic tools often get the green light.

How to use your FSA, HSA, & HRA dollars to save on electric toothbrushes?

While most electric toothbrushes aren’t typically eligible, the game changes when a dentist’s recommendation is involved. Here’s how you can use those funds to score big:

-

Get your dentist’s approval: If you’ve got gum issues or chronic plaque problems, ask your dentist for a Letter of medical necessity.

-

Shop smart: Choose electric toothbrushes with specialized features like gum care modes or plaque control brush heads. These are more likely to align with medical recommendations and get approved.

-

Keep every receipt: Whether you’re buying the brush, replacement heads, or even sanitizers, hold onto your receipts. Submit them to your FSA, HSA, or HRA for reimbursement.

-

Look beyond the brush: Did you know certain accessories, like orthodontic cleaning tools, may already qualify? Stack those savings by bundling eligible items with your electric toothbrush purchase.

Is Sonicare toothbrush FSA eligible?

Like what we said, in most cases, toothbrushes are considered personal care items, which means they’re not typically FSA eligible. But there’s a loophole that could work in your favor. If your dentist recommends a Sonicare for a specific medical condition like gum disease or severe plaque issues, it might qualify under your FSA plan.

To make it happen, you’ll need a Letter of Medical Necessity from your dentist. This letter serves as your golden ticket, proving that the toothbrush isn’t just for everyday use but for treating a legitimate health issue. Once you’ve got that, hold onto your receipts and submit them to your FSA provider.

Do you participate in an FSA, HRA or HSA program?

If you’re not already taking advantage of an FSA, HRA, or HSA, you’re missing out on a golden opportunity to save on healthcare expenses. These programs are like secret savings accounts, letting you set aside pre-tax dollars to cover a wide range of medical costs.

Each option brings its own flavor of awesome. FSAs are more suitable for predictable expenses, think regular doctor visits or prescriptions. HSAs are the MVP for long-term savings, tied to high-deductible health plans with the bonus of rolling over unused funds year after year. HRAs, funded by your employer, cover out-of-pocket costs without touching your paycheck.